Pension

New pension formula gets green light but retirement age increase still under consideration

The National Assembly’s appraisal report on the draft Social Insurance Law agreed on the new pension formula that is closer to the international standards but wanted to raise retirement age only among the groups of high-skilled and management workers.

HA NOI (ILO News) – The National Assembly’s appraisal report on the draft Social Insurance Law agreed on the new pension formula that is closer to the international standards but wanted to raise retirement age only among the groups of high-skilled and management workers.

Amid the urgency of a reform due to the shrinking pension fund, the NA report saw eye on eye with the Government on amending the current pension formula from 2016, which could lead to lower replacement rates.

“Viet Nam’s replacement rate is too high compared to the world. Actually it is one of the highest rates ILO experts have found,” Carlos Galian, ILO consultant on social security, said at a workshop organized by the National Assembly and the ILO last Tuesday evening.

Under the current laws, replacement rate is 45 per cent of average monthly wages in the first 15 years of contribution, plus 2 per cent for every following year of contribution afterwards for men and 3 per cent for women, until it reaches the maximum rate of 75 per cent.

The draft Social Insurance Law gradually increased the period of 45 per cent replacement rate to 16 years from 2016 and to 20 years from 2020.

In the world, pension systems usually provide between 40 and 60 per cent replacement rates only.

Other amendments in the draft law that take into account ILO recommendations include the expansion of social insurance coverage to workers under less-than-3-month contracts and contribution to be made on the basis of wages and allowances instead of wages only.

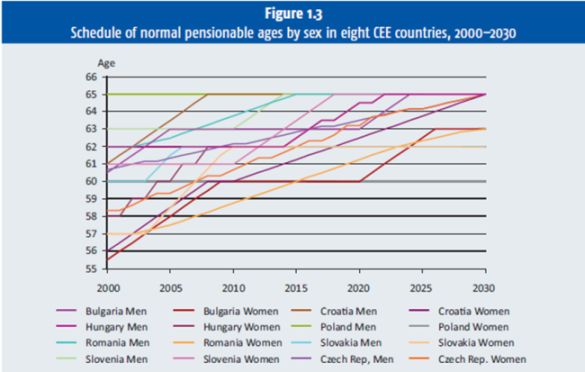

The draft law stipulates that retirement age for State employees will increase 4 months each year from 2016 until it reaches 60 years for women and 62 years for men. Meanwhile, retirement age increase road map for non-State employees will start in 2020.

“This is to ensure the balance of the pension fund,” said Minister of Labour, Invalids and Social Affairs, Nguyen Thi Hai Chuyen, at the meeting.

Under the current laws, retirement age is 55 for women and 60 for men.

However, the NA appraisal report only agreed to raise retirement age for “high-skilled and management workers and some other special cases”.

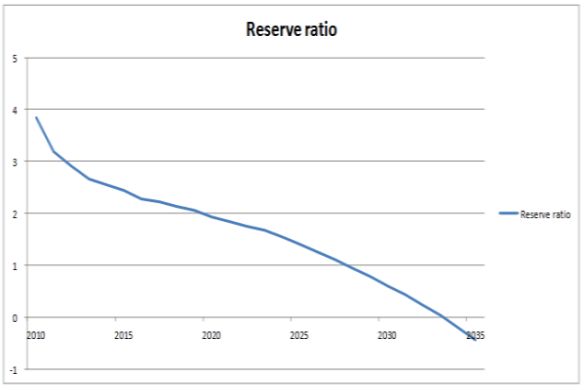

A joint research carried out by the ILO and the Government showed that if no reform is urgently passed, by 2021, the Viet Nam Social Security (VSS) contribution income will equal expenditure. The whole pension fund would be completely wiped out by 2034.

“The average retirement age in Viet Nam is now 54 and people contribute to the pension fund in 28 years and receive pension in 23-28 years,” said Galian. “Viet Nam is facing a tough choice now – whether carry out a gradual reform now; wait 3 or 5 years to implement a much more radical and harsh reform; or leave young and middle aged workers without pensions in the near future.”

Life expectancy of Vietnamese people has significantly increased from 66 in 1990 to the current 75 years. Particularly, life expectancy for those who reach 60 years of age is 82. That figure is as high as the life expectancy in much richer countries, like Brazil or Thailand, and only 3-4 years lower than Western European countries.

According to the Viet Nam Household Living Standard Survey (VHLSS) 2012, around 40 per cent of pensioners work until 65 years, even though they may not work in full-time jobs. In the informal sector, around 70 per cent workers still work at the age of 65, at least occasionally, and around 25 per cent work is on a regular basis.

“It’s important to look at the broader benefits of the reform for everyone and the society as a whole,” said ILO Viet Nam Director Gyorgy Sziraczki. “Evidences from other countries suggest that having older persons employed for as long as possible keeps them healthier mentally and physically. It also integrates them more effectively in society and enhances their financial security.”

ILO data show that Viet Nam’s labour force was projected to grow by 4.1 million between 2010 and 2015. But after that this growth will slow down significantly. From 2025 to 2030, the labour force will increase by only a mere 1.3 million – or 70 per cent less than today.

“So the issue is how to maintain growth and prosperity when labour supply is drying out in an aging society,” said the ILO Viet Nam Director.

The draft Law on Social Insurance is expected to get a green light from the NA by the end of this year.

Chairwoman of NA Committee for Social Issues, Truong Thi Mai, said the amendment of the law must aim to ensure social security for Vietnamese people by increasing the coverage of social insurance to 50 per cent of the labour force by 2020, and maintain the financial balance and sustainability of the social insurance fund.

“But this is not an easy task for developing countries with limited sources for social security,” she added.

Amid the urgency of a reform due to the shrinking pension fund, the NA report saw eye on eye with the Government on amending the current pension formula from 2016, which could lead to lower replacement rates.

“Viet Nam’s replacement rate is too high compared to the world. Actually it is one of the highest rates ILO experts have found,” Carlos Galian, ILO consultant on social security, said at a workshop organized by the National Assembly and the ILO last Tuesday evening.

Under the current laws, replacement rate is 45 per cent of average monthly wages in the first 15 years of contribution, plus 2 per cent for every following year of contribution afterwards for men and 3 per cent for women, until it reaches the maximum rate of 75 per cent.

The draft Social Insurance Law gradually increased the period of 45 per cent replacement rate to 16 years from 2016 and to 20 years from 2020.

In the world, pension systems usually provide between 40 and 60 per cent replacement rates only.

Other amendments in the draft law that take into account ILO recommendations include the expansion of social insurance coverage to workers under less-than-3-month contracts and contribution to be made on the basis of wages and allowances instead of wages only.

Retirement age

The draft law stipulates that retirement age for State employees will increase 4 months each year from 2016 until it reaches 60 years for women and 62 years for men. Meanwhile, retirement age increase road map for non-State employees will start in 2020.

“This is to ensure the balance of the pension fund,” said Minister of Labour, Invalids and Social Affairs, Nguyen Thi Hai Chuyen, at the meeting.

Under the current laws, retirement age is 55 for women and 60 for men.

However, the NA appraisal report only agreed to raise retirement age for “high-skilled and management workers and some other special cases”.

A joint research carried out by the ILO and the Government showed that if no reform is urgently passed, by 2021, the Viet Nam Social Security (VSS) contribution income will equal expenditure. The whole pension fund would be completely wiped out by 2034.

|

“The average retirement age in Viet Nam is now 54 and people contribute to the pension fund in 28 years and receive pension in 23-28 years,” said Galian. “Viet Nam is facing a tough choice now – whether carry out a gradual reform now; wait 3 or 5 years to implement a much more radical and harsh reform; or leave young and middle aged workers without pensions in the near future.”

Life expectancy of Vietnamese people has significantly increased from 66 in 1990 to the current 75 years. Particularly, life expectancy for those who reach 60 years of age is 82. That figure is as high as the life expectancy in much richer countries, like Brazil or Thailand, and only 3-4 years lower than Western European countries.

According to the Viet Nam Household Living Standard Survey (VHLSS) 2012, around 40 per cent of pensioners work until 65 years, even though they may not work in full-time jobs. In the informal sector, around 70 per cent workers still work at the age of 65, at least occasionally, and around 25 per cent work is on a regular basis.

“It’s important to look at the broader benefits of the reform for everyone and the society as a whole,” said ILO Viet Nam Director Gyorgy Sziraczki. “Evidences from other countries suggest that having older persons employed for as long as possible keeps them healthier mentally and physically. It also integrates them more effectively in society and enhances their financial security.”

ILO data show that Viet Nam’s labour force was projected to grow by 4.1 million between 2010 and 2015. But after that this growth will slow down significantly. From 2025 to 2030, the labour force will increase by only a mere 1.3 million – or 70 per cent less than today.

“So the issue is how to maintain growth and prosperity when labour supply is drying out in an aging society,” said the ILO Viet Nam Director.

|

The draft Law on Social Insurance is expected to get a green light from the NA by the end of this year.

Chairwoman of NA Committee for Social Issues, Truong Thi Mai, said the amendment of the law must aim to ensure social security for Vietnamese people by increasing the coverage of social insurance to 50 per cent of the labour force by 2020, and maintain the financial balance and sustainability of the social insurance fund.

“But this is not an easy task for developing countries with limited sources for social security,” she added.