COVID-19 and the World of Work

Rapid assessment of Montenegrin Employers Federation reveals extent of COVID-19 impact on businesses

The Montenegrin Employers Federation (MEF) presented the findings of the first rapid assessment of the impact of the COVID-19 pandemic on enterprises in Montenegro on 20 May, 2020. The assessment involved 430 businesses which responded to the survey between 10 and 30 April. The survey was based on the ILO “Enterprise survey tool: Assessing the needs of enterprises resulting from COVID-19” and conducted in partnership with the European Bank for Reconstruction and Development (EBRD).

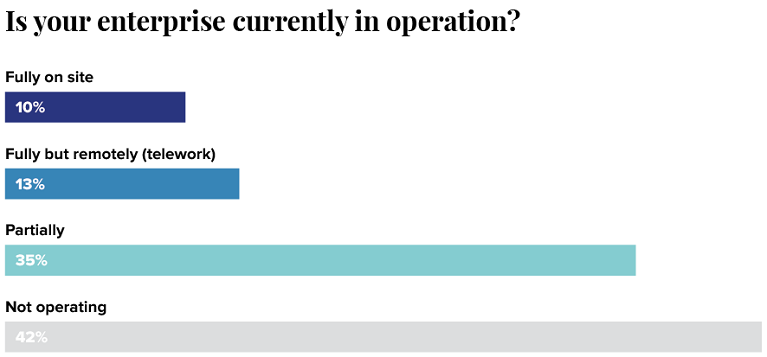

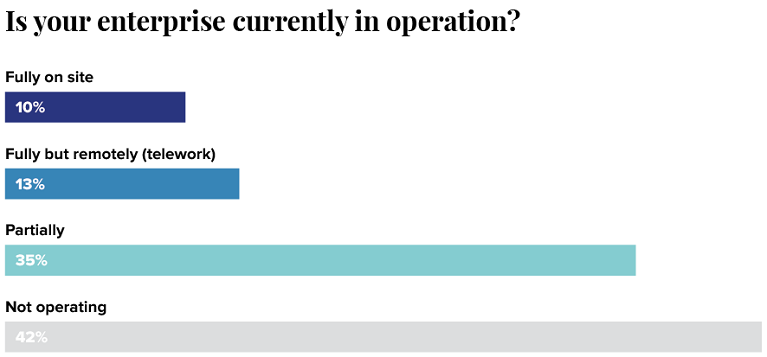

The outbreak of the COVID-19 pandemic has had a major negative effect on the activity of enterprises in Montenegro. During the survey period, over 40 per cent of enterprises were not in operation and 35 per cent were operating only partially. Micro and small enterprises face the greatest difficulties in keeping their operations afloat. More than half of micro enterprises and almost one-third of small enterprises were not in operation. Medium and large-sized enterprises appear to be less vulnerable to the crisis: only 14 percent of medium enterprises and 13 percent of large enterprises reported complete shutdown. The hardest-hit sectors in which the vast majority of businesses temporarily closed down are crafts (86 percent), restaurants (75 percent), transport (70 percent) and hotel/tourism (59 percent).

A considerable number of enterprises sees the risk of having to close in the near future. 30 percent of enterprises anticipated that they would be able to operate for the next 2 to 3 months under the current restrictions, while another 30 percent expected their businesses to be viable for only 1 to 8 weeks. Only a large percentage of large enterprises (75 per cent) responded that they would be able to survive for more than a year.

Revenue forecasts are being dramatically reduced irrespective of enterprise size or sector. On average, over one-fourth of enterprises surveyed expect a decline in revenue between 5,000 and 20,000 EUR, while a further one-fourth expect a decline between 20,000 and 100,000 EUR until end of June. Over one-fifth of enterprises expect a decline between 100,000 and 500,000 EUR and slightly more than 10% anticipate losses exceeding 500,000 EUR. Financially, this outbreak is particularly challenging for certain sectors. The highest share of enterprises anticipating a revenue drop of over 500,000 EUR came from hotel and tourism (23 percent) and retail and sales (23 percent).

While enterprises anticipate deep cuts in revenue, their ability to access alternative funds are profoundly limited. Over a half of enterprises surveyed do not have access to any funding whereas nearly 30 percent rely on loans and grants to help their businesses recover. Only a limited share (16 percent) has its own cash/savings. The cashflow challenge is most acute for micro and small enterprises with over 60 percent and near 45 percent of enterprises, respectively, noting that they do not have access to any funds. On the other hand, a good majority of medium and large-sized enterprises (50 percent and 75 percent, respectively) indicated that they have access to loans or grants.

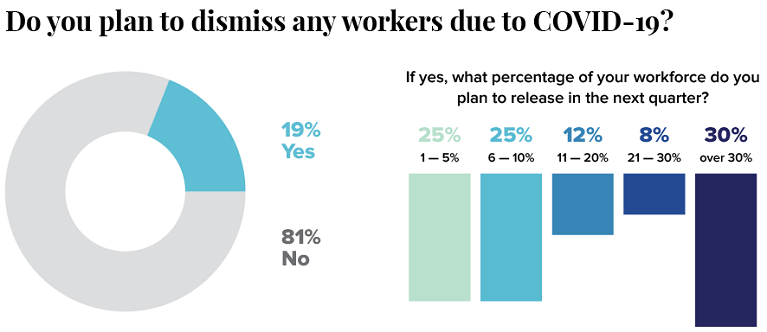

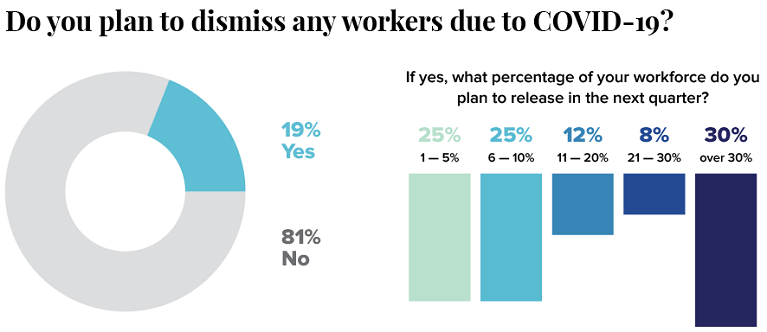

The survey also shows the impact of the pandemic on employment. The data show that 10 percent of enterprises surveyed dismissed their workers due to COVID-19, while 90 percent were able to retain them. When examining enterprise size, small-sized enterprises were at the forefront of dismissing workers (12 percent) whereas large-sized companies surveyed did not dismiss any workers. The sectors that indicate having dismissed a larger share of workers are restaurants (15 percent), hotel and tourism (13 percent), and retail and sales (13 percent). Looking into the future, unsurprisingly, a larger share of enterprises surveyed confirmed plans to reduce their workforce. Nearly one-fifth of enterprises plan to dismiss workers due to COVID-19. The highest share of enterprises indicating their plans to dismiss workers came from restaurants (25 percent) and hotel/tourism (19 percent).

The top 3 challenges faced by enterprises due to the pandemic are: working capital deficit (50 percent), incapacity of business partners to operate normally (47 percent) and low demand for products/services or restrictions to operate (both at 40 percent). Similar challenges have been identified by all types of enterprises. Yet, the most acute issue for the micro-enterprises is the incapacity to operate (48 percent) whereas large enterprises have also indicated the lack of raw materials causing disruptions in the supply chains.

When asked to rate the effectiveness of Government interventions, 45 percent of respondents indicated that government support measures partially satisfy their urgent needs and 35 percent of enterprises noted that these measures are insufficient. There is a similar perception among the micro, small and medium-sized enterprises whereas large enterprises expressed a higher level of satisfaction, with over 25 percent noting that these measures had significantly supported their needs.

In the face of this unprecedented crisis, the most urgent needs expressed by enterprises in Montenegro were access to liquidity (low interest or interest free loans); wage subsidies for companies affected by state-imposed restrictions; reducing the amount and postponing the deadlines for payroll tax payments; suspension of the enforcement procedures).

The full report is downloadable from here in Montenegrin and in English.

A considerable number of enterprises sees the risk of having to close in the near future. 30 percent of enterprises anticipated that they would be able to operate for the next 2 to 3 months under the current restrictions, while another 30 percent expected their businesses to be viable for only 1 to 8 weeks. Only a large percentage of large enterprises (75 per cent) responded that they would be able to survive for more than a year.

Revenue forecasts are being dramatically reduced irrespective of enterprise size or sector. On average, over one-fourth of enterprises surveyed expect a decline in revenue between 5,000 and 20,000 EUR, while a further one-fourth expect a decline between 20,000 and 100,000 EUR until end of June. Over one-fifth of enterprises expect a decline between 100,000 and 500,000 EUR and slightly more than 10% anticipate losses exceeding 500,000 EUR. Financially, this outbreak is particularly challenging for certain sectors. The highest share of enterprises anticipating a revenue drop of over 500,000 EUR came from hotel and tourism (23 percent) and retail and sales (23 percent).

While enterprises anticipate deep cuts in revenue, their ability to access alternative funds are profoundly limited. Over a half of enterprises surveyed do not have access to any funding whereas nearly 30 percent rely on loans and grants to help their businesses recover. Only a limited share (16 percent) has its own cash/savings. The cashflow challenge is most acute for micro and small enterprises with over 60 percent and near 45 percent of enterprises, respectively, noting that they do not have access to any funds. On the other hand, a good majority of medium and large-sized enterprises (50 percent and 75 percent, respectively) indicated that they have access to loans or grants.

The survey also shows the impact of the pandemic on employment. The data show that 10 percent of enterprises surveyed dismissed their workers due to COVID-19, while 90 percent were able to retain them. When examining enterprise size, small-sized enterprises were at the forefront of dismissing workers (12 percent) whereas large-sized companies surveyed did not dismiss any workers. The sectors that indicate having dismissed a larger share of workers are restaurants (15 percent), hotel and tourism (13 percent), and retail and sales (13 percent). Looking into the future, unsurprisingly, a larger share of enterprises surveyed confirmed plans to reduce their workforce. Nearly one-fifth of enterprises plan to dismiss workers due to COVID-19. The highest share of enterprises indicating their plans to dismiss workers came from restaurants (25 percent) and hotel/tourism (19 percent).

The top 3 challenges faced by enterprises due to the pandemic are: working capital deficit (50 percent), incapacity of business partners to operate normally (47 percent) and low demand for products/services or restrictions to operate (both at 40 percent). Similar challenges have been identified by all types of enterprises. Yet, the most acute issue for the micro-enterprises is the incapacity to operate (48 percent) whereas large enterprises have also indicated the lack of raw materials causing disruptions in the supply chains.

When asked to rate the effectiveness of Government interventions, 45 percent of respondents indicated that government support measures partially satisfy their urgent needs and 35 percent of enterprises noted that these measures are insufficient. There is a similar perception among the micro, small and medium-sized enterprises whereas large enterprises expressed a higher level of satisfaction, with over 25 percent noting that these measures had significantly supported their needs.

In the face of this unprecedented crisis, the most urgent needs expressed by enterprises in Montenegro were access to liquidity (low interest or interest free loans); wage subsidies for companies affected by state-imposed restrictions; reducing the amount and postponing the deadlines for payroll tax payments; suspension of the enforcement procedures).

The full report is downloadable from here in Montenegrin and in English.